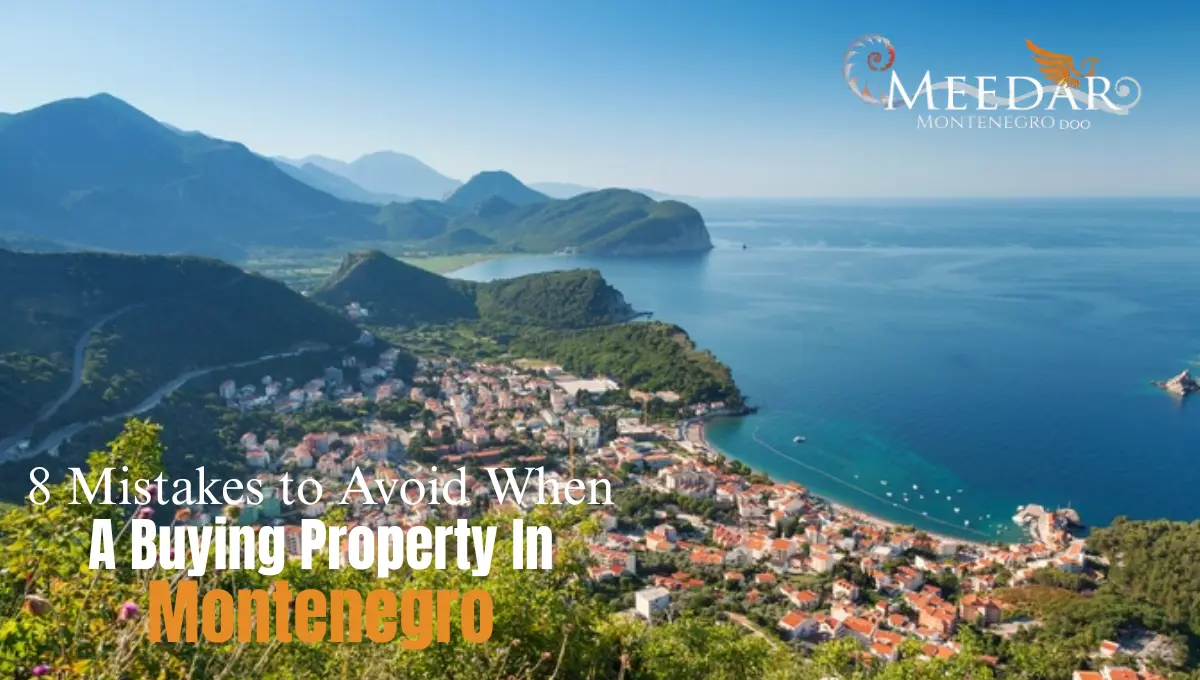

8 Mistakes to Avoid When Buying Property in Montenegro

Montenegro has become a hotspot for property investment. Its stunning coastline, beautiful mountains, and favorable tax policies attract buyers from all over the world. If you are considering buying property in Montenegro, you must approach the process carefully. Making mistakes can cost time, money, and peace of mind. In this blog, we will cover the eight most common mistakes and guide you on how to avoid them.

1. Not Researching the Local Market

The biggest mistake buyers make is jumping in without proper research. Real estate markets in Montenegro vary greatly by region. Coastal areas like Budva and Kotor are expensive and competitive, while inland properties can offer better value. Understanding property prices, trends, and potential growth is crucial. By researching the market, you can identify areas that match your budget and investment goals. Ignoring this step often leads to overpaying or buying property in the wrong location.

2. Ignoring Legal Requirements

Montenegro has specific laws for property ownership, especially for foreign buyers. Many people fail to understand these rules, which can result in legal complications. Before buying property in Montenegro, make sure you know the necessary permits, taxes, and residency regulations. Hiring a local lawyer is a smart move. They can help you check the title deed, verify ownership, and ensure that the property is free from disputes. Proper legal guidance prevents headaches later.

3. Skipping Property Inspection

Some buyers fall in love with a property based on photos alone. This is a serious mistake. Properties in Montenegro may have hidden issues like structural damage, plumbing problems, or legal restrictions. Always visit the property in person. Hire a professional inspector to evaluate its condition. An inspection helps you avoid surprises after the purchase. It also gives you leverage to negotiate a fair price.

4. Overlooking Additional Costs

Many buyers focus only on the property price. They forget about extra costs like taxes, notary fees, legal fees, and maintenance charges. Montenegro has different fees for buying property depending on location and property type. Planning your budget carefully ensures you can manage all expenses. Avoiding this mistake prevents financial stress and ensures your investment stays profitable. You should always account for around 5-10% of the property price for additional costs.

5. Failing to Verify the Developer or Seller

When buying new properties, some buyers rely solely on promises. This can be risky. Research the developer’s reputation. Check previous projects, reviews, and any legal issues. For resale properties, verify the seller’s ownership and authenticity. One bad transaction can result in a huge loss. Platforms like Meedar Montenegro can help buyers connect with trusted developers and verified listings, ensuring a safer property purchase experience.

6. Ignoring Location and Accessibility

Location is critical when buying property. Don’t just focus on the property itself. Consider proximity to essential services, schools, hospitals, and public transport. Coastal properties are attractive, but noise, congestion, and seasonal demand can affect your experience. Inland properties may offer peace but could lack accessibility. Evaluate your lifestyle and purpose—whether it’s a vacation home, rental investment, or permanent residence—before making a decision.

7. Not Considering Long-Term Investment Value

Some buyers purchase property in Montenegro without thinking about resale or rental potential. A property may look perfect now, but its value might stagnate or decrease. Consider factors like future infrastructure, tourism growth, and local economy. Properties near beaches, historical sites, or upcoming developments tend to retain or increase their value. Smart investors always analyze long-term potential to maximize returns.

8. Rushing the Purchase Process

Buying property is exciting, but rushing can lead to mistakes. Many buyers feel pressured to close quickly due to limited inventory or attractive offers. Taking your time allows for thorough research, inspections, and legal checks. A patient approach helps you make a confident decision. Remember, buying property in Montenegro is a significant investment, and careful planning ensures satisfaction and security.

FAQs

Q1. Can foreigners buy property in Montenegro?

Yes, foreigners can buy property in Montenegro. They must follow local laws and obtain necessary permits.

Q2. How do I verify a property before buying?

You should check the title deed, legal status, and ownership. Hiring a local lawyer ensures a safe purchase.

Q3. Are there extra costs when buying property in Montenegro?

Yes, expect taxes, notary fees, and legal charges. Plan around 5–10% of the property price for additional costs.

Q4. Should I hire a developer or agent for buying property?

Yes, a reliable developer or agent makes the process smoother. Platforms like Meedar Montenegro help you find trustworthy partners.

Q5. How long does it take to complete a property purchase in Montenegro?

It usually takes a few weeks to a few months, depending on legal checks, inspections, and paperwork completion.

Final Thoughts

Montenegro offers incredible opportunities for property buyers. Its natural beauty, affordable real estate, and strategic location in Europe make it highly appealing. However, success depends on avoiding common mistakes. Always research the market, understand legal requirements, inspect the property, plan your budget, verify sellers, consider location, evaluate long-term value, and take your time. By following these steps, you can make a smart investment. Using resources like Meedar Montenegro can further simplify the process, connect you with trustworthy developers and listings, and help you identify the best investment opportunity in Montenegro. By keeping these tips in mind, your journey in buying property in Montenegro can be smooth, rewarding, and profitable. With careful planning and informed decisions, you can enjoy the beauty and benefits of Montenegrin real estate without unnecessary risks.